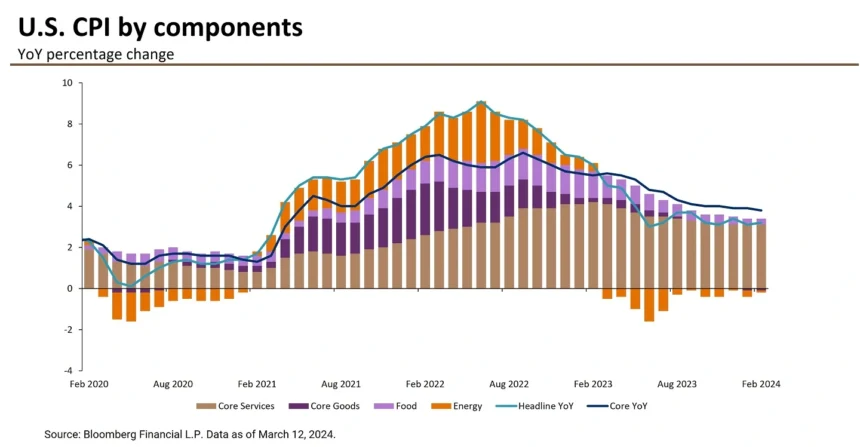

According to CPI Report 2024, The Consumer Price Index surged 3.5% in March, exceeding expectations and igniting concerns over inflationary pressures. This unexpected acceleration, primarily driven by surges in shelter and energy costs, challenges hopes for imminent interest rate cuts by the Federal Reserve.

CPI Report 2024

Stocks dipped and Treasury yields surged in response to the report’s revelation.

While energy costs rose by 1.1% following February’s 2.3% increase, shelter expenses climbed 0.4% month-on-month and soared 5.7% year-on-year. The Fed’s anticipation of cooling inflation through reduced shelter-related expenses faces skepticism amidst these persistent price hikes.

Food prices saw a modest 0.1% increase overall, but specific categories witnessed significant fluctuations, such as a 4.6% spike in egg prices juxtaposed with a 5% decline in butter costs.

However, not all sectors experienced inflationary pressure; used vehicle prices dropped by 1.1%, and medical care services prices saw a 0.6% increase.

Real average hourly earnings remained stagnant, rising only 0.6% over the past year, indicating challenges for workers amidst escalating inflation.

With market volatility on the rise and the Fed adopting a cautious stance, expectations for rate cuts have shifted. Initially slated for June, the first anticipated rate cut is now pushed to September according to CME Group calculations.

The Fed’s anticipated shift towards cutting rates faces hurdles, with officials expressing hesitancy amidst stubborn inflationary trends. While the services index surged by 0.5% in March, conflicting with the Fed’s inflation target, the likelihood of a July rate cut appears uncertain.

Also Read: Analyzing Dow Jones’s Declining Performance in 2024: A Risky Stock

As the Fed prepares to release minutes from its March meeting, investors await further insights into the central bank’s monetary policy stance. With officials expressing skepticism about lowering rates, the path forward remains uncertain, suggesting a potentially prolonged period of economic volatility and cautious market sentiment.